Tesla is facing a series of problems from falling car sales, plummeting stocks to increasingly declining market share in the US. The biggest question for the company right now is whether people will buy Tesla cars or not?

The once enviable profit margin

Tesla remains the world’s most valuable automaker , but its market capitalization has more than halved since peaking in 2021. Consumer demand has waned, while Tesla’s core product lineup has nothing new.

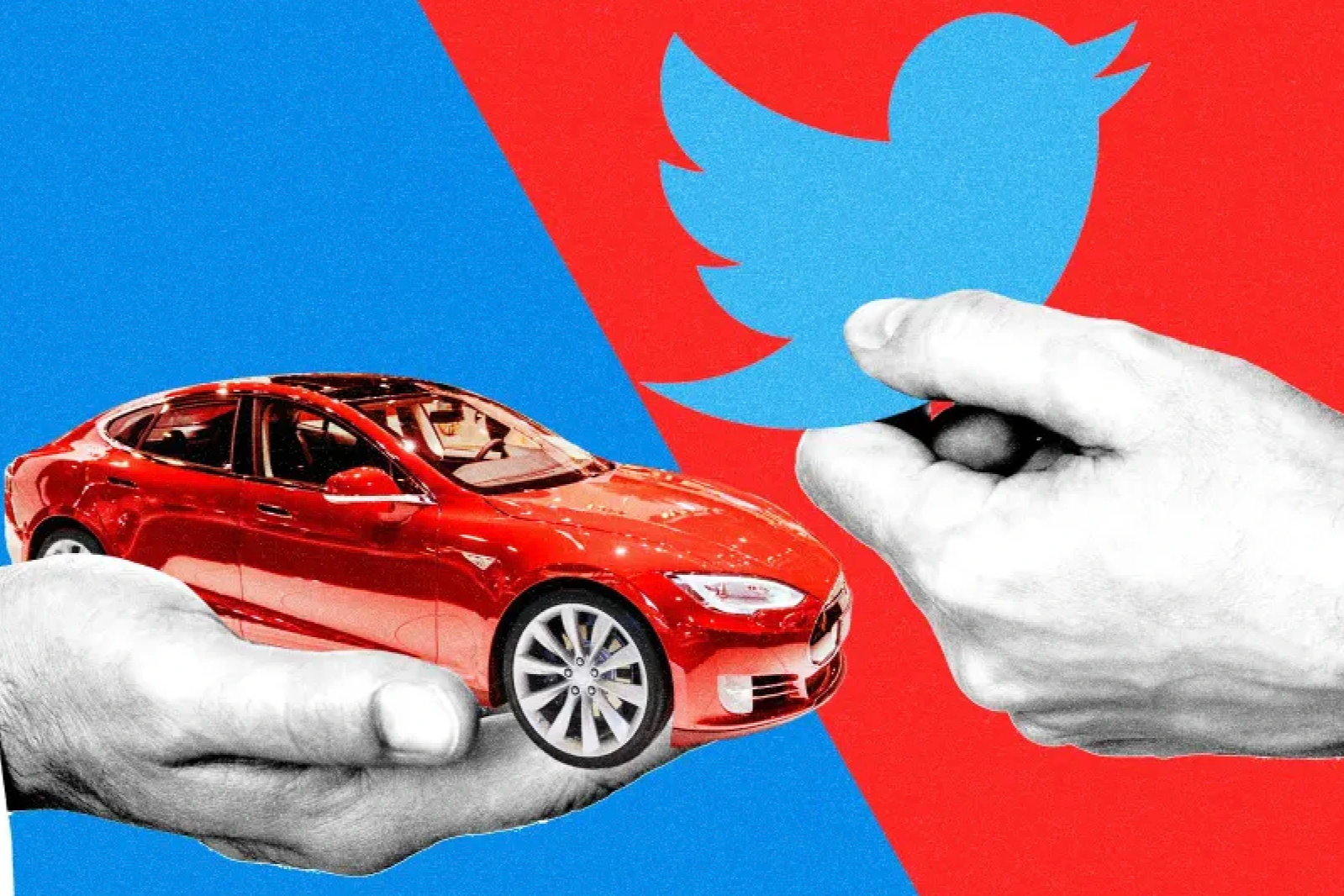

Meanwhile, billionaire Elon Musk focused on buying Twitter, selling Tesla shares and founding an artificial intelligence company. His reckless statements also gradually alienated customers from the brand that was considered the leader in the electric car industry.

Musk’s company was once a formidable force in the electric vehicle market . Tesla has been making money while many established companies have struggled to make money from electric vehicles. But the boom times are long gone. Mark Fields, former CEO of Ford Motor, says Tesla is moving from a golden age to a challenging one.

Elon Musk’s control over Tesla has been significantly reduced as the billionaire pledged shares to the bank to get money to buy Twitter

Three years ago, Tesla seemed unstoppable. Factories were humming, even as a global semiconductor shortage forced rivals to cut back on auto production. Consumer demand was so strong that Tesla had to raise prices. Waiting lists were so long that some customers were willing to pay more to own an electric vehicle.

As automakers began to build up their Tesla image, Musk, a CEO with a talent for inspiring investors, was riding the wave of artificial intelligence. “Tesla is not just an electric car company,” Musk once told investors.

In late October 2021, car rental company Hertz Global Holdings announced it had placed an order for 100,000 Tesla vehicles to expand its fleet. For investors, the deal was a sign that electric vehicles were going mainstream. Tesla’s market value eventually peaked above $1.2 trillion in early November 2021, up more than 2,000% in two years.

The golden age is coming to an end?

However, the euphoria was short-lived.

Billionaire Elon Musk quickly began selling Tesla shares and embarked on a year-long buying spree for Twitter. He later revealed that Tesla would not introduce any new models in 2022, citing supply chain constraints.

Analysts were puzzled. They questioned whether Tesla could hit its growth targets, but Musk quickly brushed aside concerns, emphasizing a future where Tesla could operate autonomously and become increasingly valuable.

As the years passed, investors grew increasingly nervous. Musk’s pursuit of Twitter only added to concerns on Wall Street that the Tesla CEO was not fully focused on making cars.

Tesla’s 2022 earnings miss Wall Street expectations. The stock also had its worst year ever, down 65%.

Faced with this reality, Tesla decided to change its sales strategy in China, increasing insurance subsidies to $1,100 for new buyers, relaunching a user referral program, and advertising its products on local TV shopping channels. This is considered extremely rare, especially for a company that once prided itself on not needing traditional advertising campaigns.

Billionaire Elon Musk during a visit to China in May 2023

The company has also faced a series of setbacks following persistent Covid-19 restrictions, adding further pressure to the stock of the leading US automaker. Musk himself has acknowledged the decline in demand for electric vehicles, which he has blamed on the Chinese real estate downturn and the European energy crisis.

In early 2023, Tesla quietly updated its website and slashed prices across its product line. The move helped Tesla’s sales for a while. The company’s vehicle prices fell about 12% globally in the first half of 2023, and deliveries rose 19% compared to the previous six months, according to Wells Fargo.

However, in the second half of 2023, as Tesla continued to cut prices and implement stimulus measures, the company’s delivery growth slowed. Some industry experts began to express their disillusionment with electric vehicles, especially when Musk’s electric pickup project Cybertruck did not meet expectations.

In China, the world’s largest auto market and Tesla’s manufacturing hub, a price war has broken out. China’s leading electric vehicle manufacturers have joined the race and are rapidly launching affordable electric vehicles, quickly dominating the domestic market.

When will the throne be regained?

Tesla recently announced that its first-quarter electric vehicle sales fell 20% year-on-year, marking the first time since the Covid-19 pandemic that its vehicle sales have declined.

Tesla said that the weakening Chinese economy, problems at its German factory and supply disruptions due to conflicts in the Middle East were the reasons for its declining sales.

However, analysts say Tesla’s problems are not entirely due to these factors. Experts say Tesla has been slow to launch products and has failed to maintain customer interest. Meanwhile, many new competitors are constantly entering the market and at some point, they will start to erode sales of billionaire Elon Musk’s electric car company.

In the US, electric vehicle sales have slowed recently, according to estimates from Cox Automotive, the world’s leading auto service provider. When Cox Automotive takes a closer look at the data, it suggests that the problem is that Teslas are becoming less attractive.

Electric vehicle sales at major automakers such as Audi, BMW, Mercedes, Rivian… all recorded growth of more than 50% over the past year, with Ford alone increasing by 86%.

“When you look at the numbers, the biggest drag on the industry is Tesla’s decline,” Valdez Streaty, an analyst at Cox Automotive, told CNN . Over the past year, US electric vehicle sales have increased 15%. Excluding Tesla, that number could be as high as 33%.

Tesla shares rose 38% last year, missing investors’ expectations for 2022. Earlier this year, the electric carmaker warned of slowing sales growth. Tesla was one of the biggest decliners in the S&P 500 for 2024. Tesla shares have fallen more than 30% this year as revenue and earnings disappointed.

Tesla vehicles accounted for about 56% of cars sold in the US last year, down from 80% in 2019. Experts say that as Americans lose interest in Tesla, the overall electric vehicle market is also dragged down.

Tesla’s two most popular products, the Model 3 and Model Y, are seven and five years old, respectively. Other companies, like Ford, Audi and Hyundai, are constantly releasing new products.

“Tesla’s two core products are excellent. But the market is flooded with new models. The competition is slowing down demand for Tesla cars,” Valdez Streaty told CNN. Chinese automakers, such as BYD, are a major threat to Tesla globally.

Another reason for Tesla’s sales decline could be Elon Musk, Tesla’s CEO. The billionaire has made some consumers reluctant to buy Tesla cars, even though they are good cars.

Elon Musk is known for his impulsive statements. A survey by Caliber, a reputation research company, found that Tesla’s image has deteriorated significantly since early 2022, when Musk made a fuss about buying Twitter. The number of customers considering buying a car has also decreased. Caliber’s data also shows that customers are gradually losing sympathy for Musk, which could affect Tesla’s business results.